Best books to improve your financial literacy.

Financial wisdom is the ability to make smart decisions about money and financial matters. It involves understanding the basics of financial literacy, such as budgeting, investing, and savings, and knowing how to use this knowledge to make wise financial choices.

Financial wisdom also includes the understanding of how to use credit responsibly, how to manage debt, and how to plan for the future. It is an important life skill that can help you achieve your financial goals and ensure financial security.

Rich Dad Poor Dad is a classic book by Robert Kiyosaki that has become a must-read for anyone interested in financial literacy. The book is written in a simple, yet powerful manner, and is filled with wisdom and insights. It is the perfect book to start your financial journey.

Through the eyes of Robert's two dads - his biological father, the 'poor dad' and his friend's father, the 'rich dad' - Robert shares valuable lessons on money, investing, and how to create financial freedom. Rich Dad Poor Dad is a great book for anyone looking to become more financially literate and learn how to manage their money wisely. Highly recommended!

The Psychology of Money by Morgan Housel is a thought-provoking and well-researched book that encourages readers to rethink their relationship with money. Housel starts by discussing the history of money and how it has shaped our behavior. He then delves into the psychological aspects of money, exploring how our beliefs and emotions influence our financial decisions. He also covers topics such as financial literacy, debt, and investing. Overall, this book is an interesting and informative read that will help readers better understand their relationship with money and make smarter financial decisions.

Why Didn’t They Teach Me This in School? is an invaluable resource for anyone looking to increase their financial literacy. Written by financial expert Cary Siegel, this book is filled with helpful advice and practical tips for making smart financial decisions. It covers topics such as budgeting, investing, retirement planning, credit, and more.

This book is well-written and easy to understand, making it suitable for readers of all backgrounds. Siegel breaks down complex financial concepts into easy-to-follow steps and provides examples to illustrate how these concepts can be applied in real life. He also includes exercises and quizzes throughout the book to help readers gauge their progress.

Overall, Why Didn’t They Teach Me This in School? is an essential guide for anyone looking to get a handle on their finances. It’s filled with useful advice and practical tips that will help readers make informed decisions and improve their financial situation. Highly recommended.

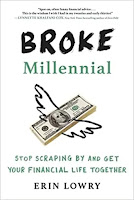

Broke Millennial by Erin Lowry is a great resource for young adults who are looking to get a better handle on their finances. The book provides an easy to understand yet comprehensive guide to financial topics such as budgeting, saving, investing, and building credit. Lowry uses her own personal experiences to provide a relatable and entertaining approach to money management.

She also offers practical tips and strategies to help readers take control of their finances and reach their financial goals. Overall, this is an informative and enjoyable read that is sure to benefit any young adult looking to get their financial life in order.

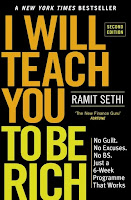

I Will Teach You To Be Rich by Ramit Sethi is an excellent book for anyone looking to take control of their finances and make smart decisions with their money. It is an easy-to-follow guide for building wealth, covering topics such as budgeting, investing, and automating your finances. Sethi provides a wealth of actionable advice, from setting up automatic payments to investing in stocks and avoiding common mistakes. His advice is practical, entertaining, and backed up by research.

Whether you are a novice or an experienced investor, this book is a great resource for anyone looking to take control of their finances and get on the road to building wealth.

Thank you so much for reading my article. I hope you learned something valuable today.

For enhancing your journey of self-improvement, check out my Blog and join the Only 1% Club.

Comments

Post a Comment